Reflecting on a day he spent at a racetrack years ago, Jimmy Bruns still remembers the reaction of two Dale Earnhardt Jr. fans when they saw their favorite driver whisked away on a golf cart.

“The look of shock and just overall awe on their face — that they had seen Dale Jr. and were standing three feet away from him — was unlike anything I’d ever seen before,” said Bruns, senior vice president of client services for GMR Marketing, which represents several major NASCAR sponsors. “If I ever think about an interaction I’ve seen between an athlete and fans, it’s those two guys just seeing their hero riding by on a golf cart for four seconds [that stands out].”

It’s that sort of next-level star power that NASCAR will try to replicate starting in 2018, when Earnhardt steps away from Monster Energy Series racing. Earnhardt — NASCAR’s most popular driver every year since 2003 and the son of the late NASCAR legend Dale Earnhardt — announced the news last week.

While NASCAR has been undergoing a major changing of the guard in recent years, and Earnhardt’s retirement had been increasingly expected, the confirmation still raises fresh questions about how well-prepared the sport is to deal with a generational shift.

At issue: Will Earnhardt’s absence mean a shrinking pie of fans and money spent in the sport, or a mere redistribution?

“Certainly for us, his father was our all-time winner with 10 wins and Junior is our second with six, and both of their last name is Earnhardt, so there’s some concern there,” said Grant Lynch, chairman of Talladega Superspeedway, a track with one of the most feverish pro-Earnhardt fan bases. “At Alabama and Auburn [with college football], you get new players every three years. Well, our sport has always been, ‘You pick a driver and you stay with him,’ but that doesn’t mean that there aren’t a lot of other great drivers coming up with bright futures.”

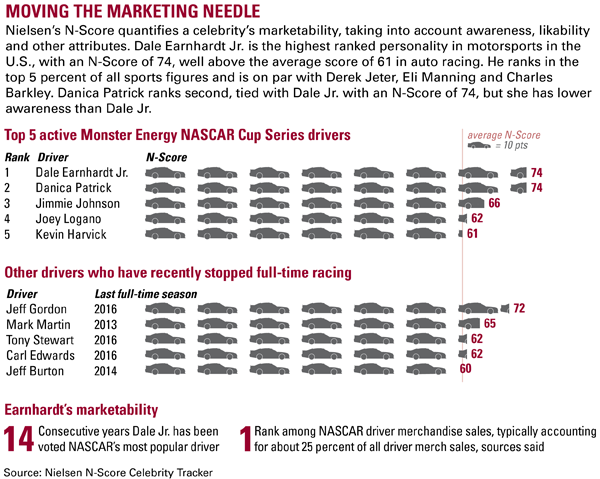

The outsized magnitude of Earnhardt’s popularity can be seen in numerous ways. He has the highest score of any driver in the U.S. in Nielsen’s N-Score Celebrity Tracker (see chart). His merchandise has typically represented about 25 percent of all driver merchandise sales over the course of his career, Joe Mattes, vice president of marketing and licensing for JR Motorsports, said last year. Earnhardt was the subject of NASCAR’s most-viewed social media post ever, and has by far the most Facebook likes of any driver in NASCAR.

Moreover, Earnhardt has enjoyed a highly lucrative corporate sponsorship and endorsement career, with memorable long-term partners including Budweiser, Chevrolet and Nationwide. Hendrick Motorsports was said to command $1 million per race for each primary sponsor of his No. 88 Chevrolet earlier in his career, a figure that may never be matched again in NASCAR.

As the sport begins to ponder life without Earnhardt on the track, a polling of more than two dozen industry executives last week found that most are confident the sport will continue to be healthy and of a similar magnitude without Earnhardt, though there are some sounding the alarm bells.

From a short-term perspective, most track presidents who spoke last week said they foresee an initial boost coming from the announcement, under the thinking that fans will want to get a last glimpse of Earnhardt on the track. From a long-term perspective, Earnhardt also co-owns JR Motorsports, a NASCAR Xfinity Series team, and has expressed an openness to getting into broadcasting, so executives are hoping that him staying close to the sport the way Jeff Gordon has could further mitigate his on-track absence.

“You’re still going to see Dale Jr. around the track and I think fans will respond favorably to it,” said Eddie Gossage, president of Texas Motor Speedway. “So I don’t know if we’re going to see much change.”

Still, many in the sport said perhaps the most comparable situation they could think of to Earnhardt’s was that of Tiger Woods, who has not retired from golf but who has been saddled by personal issues and injuries in recent years. The golf industry often pointed to a “Tiger Woods Effect” on ratings.

“When Tiger Woods enters a tournament, people watch, and when Dale Earnhardt Jr. is in the lead or hunt for the lead, people watch,” said Andrew Campagnone, senior managing partner at Sports Marketing Consultants. “He transcends the sport, but that’s not going to happen anymore until the next star comes, and who knows who that star will be?”

For now, most are pegging their hopes on young but increasingly established drivers including Chase Elliott, Kyle Larson, Ryan Blaney, Joey Logano and Erik Jones, along with diverse up-and-comers Daniel Suarez and Darrell Wallace Jr. Many also note that manufacturers including Toyota and Ford have well-invested development programs that are beginning to bear fruit.

But as ratings and attendance continue to decline incrementally in NASCAR, some are concerned about whether there will be substantial Earnhardt attrition, as well as whether the sport could suffer from not having the crossover appeal that Earnhardt brought the sport through his routine appearances in the mainstream media.

Mattes, the vice president at JR Motorsports, which manages licensing for Hendrick Motorsports, said Elliott is seeing year-over-year upticks in sales of his merchandise, a trend that goes against what has historically been seen in NASCAR for second-year Cup drivers. While merchandise is just one element of a driver’s popularity, Mattes thinks it bodes well.

“Historically speaking in our sport, the sophomore season is a slump; you go back to the test of time: The [Tony Stewarts] and [Jimmie Johnsons] and all the guys who came through the system [saw second-year declines],” Mattes said. “That’s a bellwether. … It’s a really great indicator.”

Some sources noted that NASCAR is in the third year of its 10-year media rights deals with NBC Sports and Fox Sports. Theoretically, they said, that makes now a better time to go through a substantial changing of the guard since any renewal talks are likely years away.

“Maybe there’s a little element to that, but all these major sports properties have iconic athletes that come and go over time, and it’s the sport itself and brand that is the main driver,” said Chris Bevilacqua, co-founder of Bevilacqua Helfant Ventures, a media consulting firm. “As a sports property, I think they’ll be fine.”